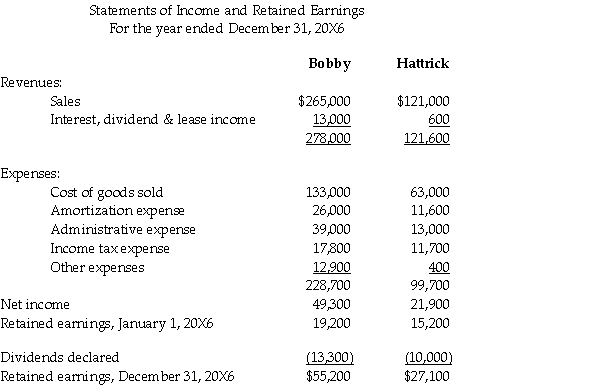

Hattrick Corp.is a wholly owned,parent-founded subsidiary of Bobby Inc.The unconsolidated statements of income and the statement of changes of retained earnings for the two companies for the year ended December 31,20X6,are as follows (in 000s):

Additional information:

• Bobby sells some of its output to Hattrick.During 20X6,intercompany sales amounted to $25,000,000.Hattrick has accounts payable owing to Bobby for $200,000 at December 31,20X6.

• Bobby owns the land on which Hattrick's building is located.Bobby leases the land to Hattrick for $30,000 per month.

Bobby accounts for its investment in Hattrick under the cost method

Assume that Bobby is a private corporation that reports under ASPE.Prepare the statement of income and retained earnings for Bobby for the year 20X6 using the equity method.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: On January 1,20X2,Soho Co.purchased 4,000 shares,representing 12%,of

Q25: On January 1,20X8,XZ Co.purchased 3,000 shares,representing 30%

Q25: Jarrett Corporation uses the equity method to

Q27: At the beginning of 20X1,Rally Ltd.acquired 18%

Q28: On February 1,20X5,Peter Co.purchased 20% of the

Q31: Ying Corporation formed a new subsidiary,Zang Limited,in

Q32: Gunnar Ltd.owns 100% of the common shares

Q33: Ritva Co purchased a 38% interest in

Q34: Hattrick Corp.is a wholly owned,parent-founded subsidiary of

Q35: Jonas Co. owned 60% of Kara Co.'s

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents