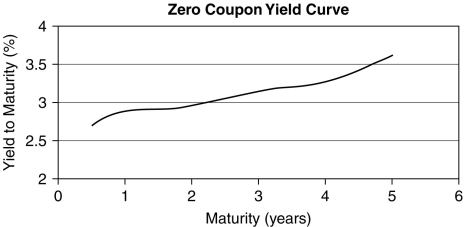

Use the figure for the question(s) below.

-A risk-free,zero-coupon bond has 15 years to maturity.Which of the following is closest to the price per $100 of face value that the bond will trade at if the YTM is 7%?

A) $29.55

B) $32.68

C) $36.24

D) $38.78

Correct Answer:

Verified

Q10: Prior to its maturity date, the price

Q17: An investor holds a Ford bond with

Q18: Q18: The coupon value of a bond is Q19: Why is the yield to maturity of Q21: Which of the following risk-free, zero-coupon bonds Q22: Consider a zero-coupon bond with a $1000 Q23: Under what situation can a zero-coupon bond Q24: Which of the following statements is FALSE? Q26: Use the figure for the question(s)below. ![]()

A)Zero-coupon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents