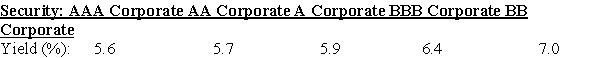

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

A) $947.22

B) $967.64

C) $1013.91

D) $1016.41

Correct Answer:

Verified

Q63: Which of the following bonds will be

Q72: Which of the following bonds will be

Q78: Before it matures, the price of any

Q78: A company releases a five-year bond with

Q84: A firm issues ten-year bonds with a

Q85: A company issues a ten-year bond at

Q86: Use the information for the question(s)below.

Q88: A twenty year bond with a $1000

Q90: Bonds with a high risk of default

Q95: The credit spread of a bond shrinks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents