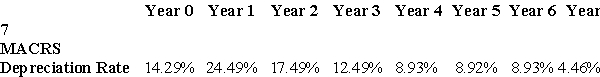

A textile company invests $12 million in an open-end spinning machine.This was depreciated using the seven-year MACRS schedule shown above.If the company sold it immediately after the end of year 3 for $7 million,what would be the after-tax cash flow from the sale of this asset,given a tax rate of 40%?

A) $1,300,480

B) $1,950,720

C) $2,076,880

D) $5,699,520

Correct Answer:

Verified

Q65: Firms should use the most accelerated depreciation

Q66: Q67: Joe pre-orders a non-refundable movie ticket.He then Q70: If a business owner is using the Q71: A firm is considering changing their credit Q73: An insurance office owns a large building![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents