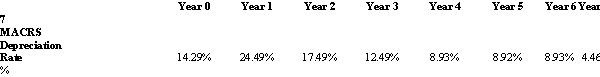

Massive Amusements,an owner of theme parks,invests $60 million to build a roller coaster.This can be depreciated using the MACRS schedule shown above.How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year,straight-line depreciation,if the tax rate is 40%?

A) $1,077,429

B) $1,285,371

C) $2,143,200

D) $6,428,229

Correct Answer:

Verified

Q68: What are the most difficult parts of

Q75: A company spends $20 million researching whether

Q76: Q77: A firm is considering a new project Q80: A firm is considering investing in Q81: Use the table for the question(s)below. Q82: The manufacturer of a brand of kitchen Q83: Use the figure for the question(s)below. Q89: Use the figure for the question(s) below. Q94: What are project externalities?![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents