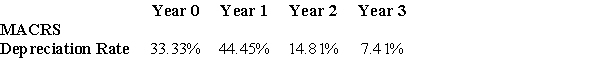

A machine is purchased for $500,000 and is used through the end of Year 2.The machine will be depreciated using the 3-Year MACRS schedule.At the end of Year 2,the machine is sold for $75,000.What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 40%?

A) $37,050

B) $15,180

C) $37,950

D) $59,820

Correct Answer:

Verified

Q61: An announcement by the government that they

Q62: Q63: Use the table for the question(s)below. Q65: Firms should use the most accelerated depreciation Q67: Joe pre-orders a non-refundable movie ticket.He then![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents