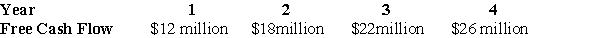

Conundrum Mining is expected to generate the above free cash flows over the next four years,after which they are expected to grow at a rate of 5% per year.If the weighted average cost of capital is 12% and Conundrum has cash of $80 million,debt of $60 million,and 30 million shares outstanding,what is Conundrum's expected terminal enterprise value?

A) $371.4 million

B) $390.0 million

C) $410.0 million

D) $391.4 million

Correct Answer:

Verified

Q2: Which of the following statements is FALSE?

A)The

Q3: Gonzales Corporation generated free cash flow of

Q4: Use the table for the question(s)below.

Q5: Gonzales Corporation generated free cash flow of

Q7: Which of the following statements is FALSE?

A)The

Q7: In the method of comparables, the known

Q8: If you want to value a firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents