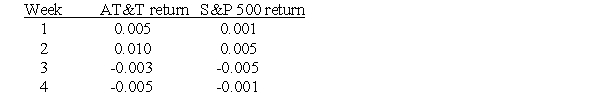

You observe that AT&T stock and the S&P 500 have the following weekly returns:

If this pattern of stock returns is typical of AT&T stock,and you calculated a beta against the S&P 500,which of the following is true?

A) AT&T's beta is negative

B) AT&T's beta is zero

C) AT&T's beta is positive

D) Cannot be determined from information given.

Correct Answer:

Verified

Q53: Use the table for the question(s)below.

Consider the

Q68: How does the S&P 500 index rank

Q76: For each 1% change in the market

Q77: You expect General Motors (GM) to have

Q77: A stock market comprises 1000 shares of

Q77: The market or equity risk premium can

Q83: UPS,a delivery services company,has a beta of

Q84: The Capital Asset Pricing Model asserts that

Q85: UPS,a delivery services company,has a beta of

Q96: The Capital Asset Pricing Model (CAPM)says that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents