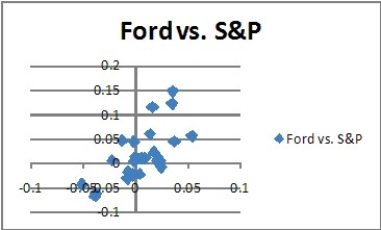

You observe the following scatterplot of Ford's weekly returns against the S&P 500.Which of the following statements is true about Ford's beta against the S&P 500?

A) Ford's beta appears to be positive.

B) Ford's beta appears to be negative.

C) Ford's beta appears to be zero- there is no apparent relation between its return and the S&P return.

D) Beta has nothing to do with the relationship seen in this scatterplot.

Correct Answer:

Verified

Q61: A linear regression was done to estimate

Q64: If you build a large enough portfolio,you

Q69: The S&P 500 index traditionally is a

Q69: The beta of the market portfolio is

Q70: Since total risk is greater than systematic

Q71: The amount of a stock's risk that

Q71: Companies that sell household products and food

Q72: Is it possible for a stock to

Q73: You expect General Motors (GM) to have

Q74: You expect General Motors (GM) to have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents