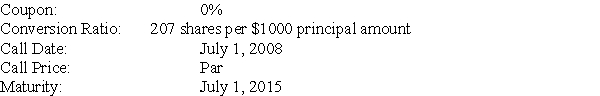

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $4.95.If the bonds are called on this date,which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A) Convert the bond and accept shares with a value of $10,000.

B) Convert the bond and accept shares with a value of $10,128.00.

C) Convert the bond and accept shares with a value of $10,246.50.

D) Accept the call price and receive $10,000.

Correct Answer:

Verified

Q42: Covenants in a bond contract restrict the

Q43: What are the implications of stronger bond

Q46: What are debentures?

Q48: If a bond covenant is not met,

Q59: A company issues a callable (at par)

Q62: Which of the following statements concerning the

Q63: A bond with a face value of

Q66: Supreme Industries issues the following announcement to

Q67: A company issues a callable (at par)

Q79: A company issues a callable (at par)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents