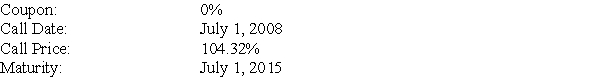

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $28.20.What is the minimum conversion ratio that would make a bondholder prefer to convert rather than accept the call price?

A) 32 shares per $1000 principal amount

B) 35 shares per $1000 principal amount

C) 37 shares per $1000 principal amount

D) 41 shares per $1000 principal amount

Correct Answer:

Verified

Q41: Which of the following statements is FALSE?

A)The

Q42: Which of the following statements is FALSE?

A)The

Q52: Which of the following statements is FALSE?

A)When

Q81: Which of the following statements regarding sinking

Q83: What is yield to call?

Q87: A company issues a 10-year,callable bond at

Q88: When a callable bond sells at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents