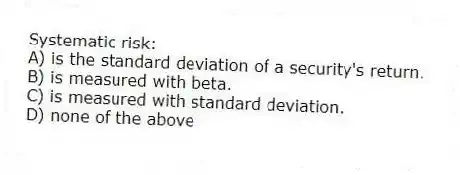

Systematic risk:

A) is the standard deviation of a security's return.

B) is measured with beta.

C) is measured with standard deviation.

D) none of the above

Correct Answer:

Verified

Q13: Relatively high costs of capital are more

Q14: Which of the following will NOT affect

Q15: A firm whose equity has a beta

Q16: The difference between the expected (or required)

Q17: The weighted average cost of capital (WACC)

Q19: Beta may be defined as:

A) the measure

Q20: _ risk is measured with beta.

A) Systematic

B)

Q21: Instruction 13.1:

Use the information to answer the

Q22: Unsystematic risk:

A) is the remaining risk in

Q23: Other things equal, an increase in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents