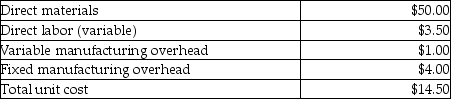

Apex Company produces artificial Christmas trees.A local shopping mall recently made a special order offer;the shopping mall would like to purchase 200 extra-large white trees.Apex Company is currently producing and selling 20,000 trees;the company has the excess capacity to handle this special order.The shopping mall has offered to pay $120 for each tree.An accountant at Apex Company provides an estimate of the unit product cost as follows:

This special order would require an investment of $10,000 for the molds required for the extra-large trees.These molds would have no other purpose and would have no salvage value.The special order trees would also have an additional variable cost of $5.00 per unit associated with having a white tree.This special order would not have any effect on the company's other sales.If the special order is accepted,the company's operating income would increase (decrease) by

A) $2,300 decrease.

B) $13,100 decrease.

C) $2,100 increase.

D) $13,100 increase.

Correct Answer:

Verified

Q43: Pluto Incorporated provided the following information regarding

Q44: Blue Technologies manufactures and sells DVD players.Great

Q45: The following information relates to current production

Q46: Sky High Seats manufactures seats for airplanes.The

Q47: The following information relates to current production

Q49: Samson Incorporated provided the following information regarding

Q50: Comfort Cloud manufactures seats for airplanes.The company

Q51: ABC Toys manufactures and sells wooden toys

Q52: Samson Incorporated provided the following information regarding

Q53: The following information relates to current production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents