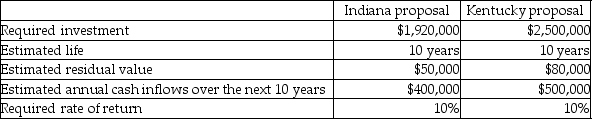

O'Mally Department Stores is considering two possible expansion plans.One proposal involves opening 5 stores in Indiana at the cost of $1,920,000.Under the other proposal,the company would focus on Kentucky and open 6 stores at a cost of $2,500,000.The following information is available:

The payback period for the Indiana proposal is closest to

A) 3.8 years.

B) 5.0 years.

C) 4.8 years.

D) 38.4 years.

Correct Answer:

Verified

Q21: One disadvantage of the payback method is

Q29: All else being equal, a company would

Q37: Gomez Corporation is considering two alternative investment

Q39: Gomez Corporation is considering two alternative investment

Q41: The Warren Company is considering investing in

Q43: Cowell Corporation is considering an investment in

Q44: The Warren Company is considering investing in

Q45: Landrum Corporation is considering investing in specialized

Q46: Gomez Corporation is considering two alternative investment

Q47: O'Mally Department Stores is considering two possible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents