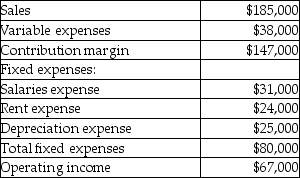

Buxton Corporation is evaluating a capital investment project which would require an initial investment of $240,000 to purchase new machinery.The annual revenues and expenses generated specifically by this project each year during the project's nine year life would be:

The residual value of the machinery at the end of the nine years would be $15,000.The payback period of this potential project in years would be closest to

A) 2.6.

B) 3.6.

C) 3.1.

D) 1.4.

Correct Answer:

Verified

Q57: The Hanna Company uses straight-line depreciation and

Q58: The Warren Company is considering investing in

Q59: O'Mally Department Stores is considering two possible

Q60: The Warren Company is considering investing in

Q61: Globe Enterprises purchased a new machine with

Q63: Sparky the Electrician specializes in rewiring historic

Q65: Pro-Am Audio is a company that is

Q66: Siesta Manufacturing has asked you to evaluate

Q87: The net present value method does not

Q96: The principal amount, the interest rate, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents