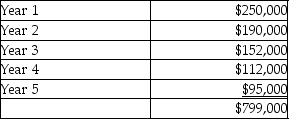

(Present value tables are needed. ) Somerville Corporation is considering investing in specialized equipment costing $618,000.The equipment has a useful life of 5 years and a residual value of $55,000.Depreciation is calculated using the straight-line method.The expected net cash inflows from the investment are:

Somerville Corporation's required rate of return is 14%.

The net present value of the investment is closest to

A) $62,976 negative.

B) $5,886 negative.

C) $34,431 negative.

D) $181,000 positive.

Correct Answer:

Verified

Q155: (Present value tables are required. )Hincapie Manufacturing

Q156: (Present value tables are needed. )Cleveland Cove

Q157: Senseman Company has three potential projects from

Q158: (Present value tables are needed. )The Janus

Q159: (Present value tables are needed. )The Janus

Q162: (Present value tables are needed. )Georgia Peach

Q164: (Present value tables are needed. )Shaker Investments,a

Q165: Icy Peaks Sports makes snowboards.The company wants

Q195: The net present value model differs from

Q197: The discounted cash flow methods for capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents