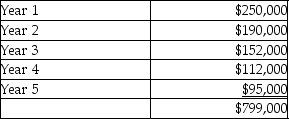

(Present value tables are needed. ) Somerville Corporation is considering investing in specialized equipment costing $618,000.The equipment has a useful life of 5 years and a residual value of $55,000.Depreciation is calculated using the straight-line method.The expected net cash inflows from the investment are:

Somerville Corporation's required rate of return is 14%.

Is the internal rate of return of the investment equal to,higher than,or lower than 14%?

A) Equal to 14%

B) Higher than 14%

C) Lower than 14%

D) Cannot be determined from the given data

Correct Answer:

Verified

Q146: (Present value tables are needed. )Mulheim Corporation

Q147: (Present value tables are needed. )Cleveland Cove

Q148: (Present value tables are needed. )Cleveland Cove

Q149: (Present value tables are required. )Currence Corporation

Q150: (Present value tables are needed. )The Janus

Q152: (Present value tables are needed. )Cleveland Cove

Q153: (Present value tables are required. )Vino Winery

Q154: (Present value tables are needed. )The Janus

Q155: (Present value tables are required. )Hincapie Manufacturing

Q156: (Present value tables are needed. )Cleveland Cove

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents