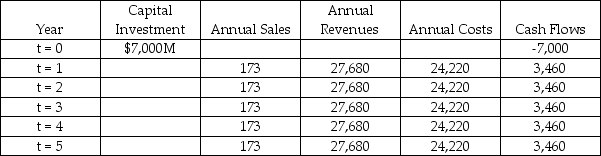

What is the NPV of the Boeing 787 Dreamliner project? The Boeing 787-8 can carry 230 passengers up to 8,200 nautical miles at a cruising speed of mach 0.85.The Dreamliner is more comfortable for passengers because of higher cabin humidity.Boeing completed construction on its final assembly plant at time t = 0 for a total cost of $7B.Boeing has secured orders for 865 aircraft over the next five years (t = 1 to t = 5) for total proceeds of $138.4B ($160M per aircraft) .The cost of building each plane is $140M.Assume that cash flows (sales and costs) occur at the end of each year starting one year after the assembly plant was completed.The project cash flows are shown in the table,below.What is the NPV of the project if Boeing's cost of capital is 10%? Calculate the NPV as of time t=0.(Round answer to the nearest million) .

A) $6,116M

B) $8,069M

C) $8,780M

D) $8,967M

E) $13,116M

Correct Answer:

Verified

Q17: Most errors committed in capital budgeting analysis

Q18: The most widely used capital budgeting technique

Q19: Two projects each require a current cash

Q20: According to the net present value technique,a

Q21: The _ is the exact amount of

Q23: Michigan Mattress Company is considering the purchase

Q24: All of the following are considered to

Q25: Two projects being considered are mutually exclusive

Q26: What is the NPV of the Airbus

Q27: In 1967,Lockheed planned to build a wide-bodied

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents