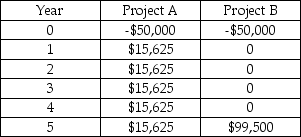

Two projects being considered are mutually exclusive and have the following projected cash flows:

If the required rate of return on these projects is 10%,which would be chosen and why?

A) B, because of higher NPV.

B) B, because of higher IRR.

C) A, because of higher NPV.

D) A, because of higher IRR.

E) Neither, because both have IRRs less than the cost of capital.

Correct Answer:

Verified

Q20: According to the net present value technique,a

Q21: The _ is the exact amount of

Q22: What is the NPV of the Boeing

Q23: Michigan Mattress Company is considering the purchase

Q24: All of the following are considered to

Q26: What is the NPV of the Airbus

Q27: In 1967,Lockheed planned to build a wide-bodied

Q28: The _ method to analyze cash flows

Q30: Bernhard Stroh is the Master Brewer at

Q101: A firm is evaluating an investment proposal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents