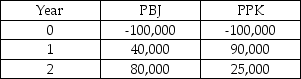

Fritz Walther,the CEO of Carl Walther Sportwaffen GmbH,is choosing between two mutually exclusive projects: 1) the Walther PBJ; and 2) the Walther PPK.Both projects involve an investment of $100,000.The operating cash flows for each project are shown in the table.The opportunity cost of capital is 10%.The PBJ project has an IRR of 11.65% and the PPK project has an IRR of 12.27%.Which project should Fritz choose (and why) ?

A) Choose the PPK project because its IRR is greater.

B) Choose the PPK because its NPV is higher.

C) Choose the PBJ because its NPV is higher.

D) Choose the PPK because it generates more operating cash flows.

E) Choose either because they both have the same NPV.

Correct Answer:

Verified

Q32: What is the payback period for the

Q34: Sara Flea Collar Inc.is evaluating an overseas

Q35: Which of the following capital budgeting methods

Q36: The least desirable capital budgeting technique from

Q38: What is the NPV of the F-22

Q39: What is the payback period of the

Q40: Going Postal Service Inc.is considering an upgrade

Q41: Comparing net present value and internal rate

Q42: Genuine Products Inc.requires a new machine.Two companies

Q68: Unsophisticated capital budgeting techniques do not

A) examine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents