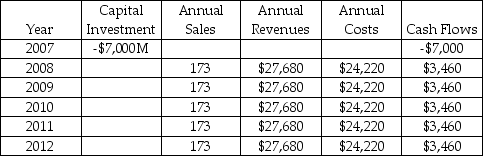

What is the Profitability Index of the Boeing 787 Dreamliner project? The Boeing 787-8 can carry 230 passengers up to 8,200 nautical miles at a cruising speed of mach 0.85.The Dreamliner is more comfortable for passengers because of higher cabin humidity.Boeing completed construction its assembly plant in Everett Washington in December 2007 at a total cost of $7B.Boeing has secured sales of 865 aircraft over the period 2008-2012 for total proceeds of $138.4B ($160M per aircraft) .The cost of building each plane is $140M.Assume that sales (and costs) occur in December of each year.Assume that sales are spread evenly across the five years from 2008-2012.The project cash flows are shown in the table,below.What is the Profitability Index of the project if Boeing's cost of capital is 10%? Calculate the index as of December 1,2007.Ignore taxes.

A) -1.52

B) -0.44

C) 1.06

D) 1.87

E) 2.43

Correct Answer:

Verified

Q76: Two projects being considered by a firm

Q77: What is the IRR of the F-22

Q78: When the net present value is negative,the

Q79: A firm is evaluating two independent projects

Q80: Which of the following statements is incorrect?

A)

Q82: A project costs $12,000 and has a

Q83: The project cash flows and Profitability Indexes

Q84: The project cash flows and Profitability Indexes

Q85: The project cash flows and NPVs for

Q86: A firm is considering the following independent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents