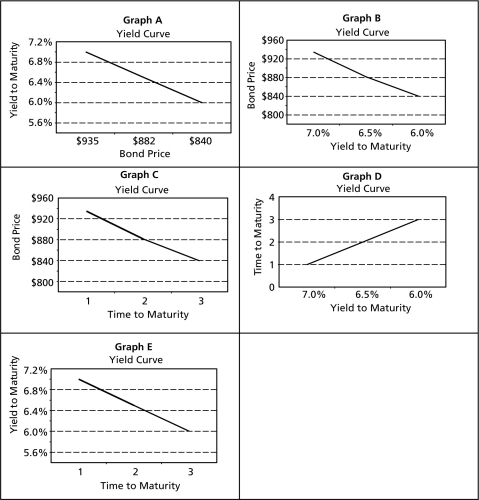

Which of the graphs below is the correct depiction of the yield curve given the data on the three zero coupon bonds in the table below?

Zero Coupon Bond Prices and Yields

A) Graph A

B) Graph B

C) Graph C

D) Graph D

E) Graph E

Correct Answer:

Verified

Q15: The Associated Dry Goods Corp.zero coupon bond

Q16: Consider a $1,000 face value zero coupon

Q17: How much should an investor pay for

Q18: What is the yield to maturity of

Q19: The real rate of interest is 2%

Q21: Consider a 35 year coupon bond with

Q22: Assume that Microsoft bonds have just left

Q23: In September 2000 the Pullman Group arranged

Q24: Schlitz Brewery Inc.bonds are trading today for

Q25: Consider a 30 year coupon bond with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents