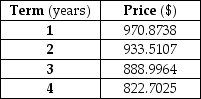

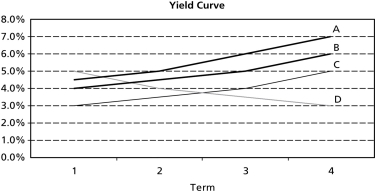

The table below shows market prices for four zero coupon bonds with four different terms: one,two,three and four years.The bonds all have a face value of $1,000.Which line best represents the yield curve derived from the bond prices in the table? Use the letter labels at the end of each line.

Zero Coupon Bond Prices

A) A

B) B

C) C

D) D

Correct Answer:

Verified

Q21: Consider a 35 year coupon bond with

Q22: Assume that Microsoft bonds have just left

Q23: In September 2000 the Pullman Group arranged

Q24: Schlitz Brewery Inc.bonds are trading today for

Q25: Consider a 30 year coupon bond with

Q27: The bonds of Vandalay Inc.pay annual coupons

Q28: A 2-year T-Note has a face value

Q29: Consider a 35 year coupon bond that

Q30: Consider a 6-year corporate bond issued by

Q31: The US Government has a 3-year 5%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents