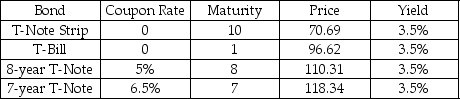

Each bond in the table has a face value of $100.The coupon bonds pay annual coupons,and the next coupon is due in one year.Assume that the yield curve is flat and all yields are currently 3.5%.If interest rates are forecast to rise to 4% from 3.5%,what is your profit if you short-sell the bond with the biggest anticipated (percentage) decline.(Assume you short-sell only one bond.)

A) -$3.13

B) -$2.13

C) $2.13

D) $3.13

E) $4.13

Correct Answer:

Verified

Q71: Suppose that you are reviewing a price

Q72: A US Government bond has 15 years

Q73: Microsoft just issued a bond with annual

Q74: Consider two recent bond issues by Microsoft:

Q75: In general,if interest rates _,bond prices _.

A)

Q77: Which of the following bonds carries the

Q78: The economy is slowing and many forecasters

Q79: A $1,000 face value bond has a

Q80: A bond sells at a discount when

A)

Q81: If the yield to maturity on Wee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents