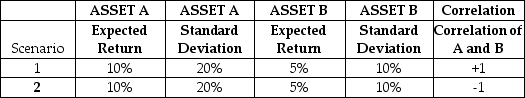

An investor is considering investing one-half of his wealth in Asset A and one-half in Asset B.He is not sure how the two assets are correlated.The correlation might be r = +1 or it might be r = -1.If it is r = + 1,then the portfolio standard deviation is 15%.Calculate the portfolio standard deviation if the correlation is r = -1.What is the difference between the standard deviations of Scenario 1 and Scenario 2? (Scenario 1 - Scenario 2)

A) 2.5%

B) 5.0%

C) 7.5%

D) 10.0%

E) 15.0%

Correct Answer:

Verified

Q13: Delilah Jones has a portfolio of stocks

Q14: Stocks A and B are perfectly negatively

Q15: The reason for diversification is to reduce

Q16: How would you describe the risk of

Q17: Consider the data provided in the table

Q19: Can the return on a portfolio ever

Q20: _ is the act of giving something

Q21: An increase in nondiversifiable risk

A) would have

Q22: In a well-diversified portfolio,the most relevant type

Q23: _ is what investors do when they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents