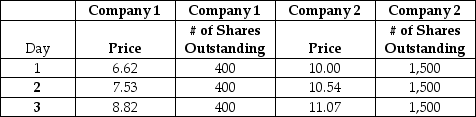

A popular value-weighted index is constructed out of shares in the two companies,shown in the table below.On Day 1 you construct a portfolio that mimics the index with 15% invested in Company 1 and 85% invested in Company 2.On Day 2,what trades do you need to make in order to adjust your portfolio weights so that your portfolio earns the same return as the index from Day 2 to Day 3?

A) Buy more of Company 1 and buy more of Company 2

B) Buy more of Company 1 and sell some of Company 2

C) Sell some of Company 1 and sell some of Company 2

D) Sell some of Company 1 and buy more of Company 2

E) Make no trades

Correct Answer:

Verified

Q29: In a well-diversified portfolio,the most relevant type

Q30: Consider a value-weighted market index that includes

Q31: CISCO System's stock has a correlation with

Q32: Which of the following statements is false?

A)

Q33: If the stock market becomes more risky

Q35: _ risk can be eliminated by diversification.

A)

Q36: Beta is a more relevant measure of

Q37: A popular value-weighted index is constructed out

Q38: The slope of the characteristic line is

Q39: Consider a value-weighted market index that includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents