A friend tips you off on a hot stock: Sure Thing Mines Ltd.You only have $10,000 to invest but you want to invest more.Assume that you can borrow an additional $5,000 by short-selling the risk free asset (issuing T-Bills) .You purchase $15,000 worth of shares in Sure Thing Mines Ltd.

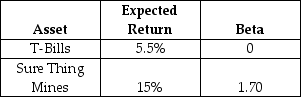

The expected returns and standard deviations of the two assets are outlined in the table below:

What is the beta of the portfolio?

A) 1.50

B) 1.70

C) 2.50

D) 2.55

E) 2.70

Correct Answer:

Verified

Q65: Peter Lynch has the following portfolio of

Q66: You want to buy $20,000 worth of

Q67: Your video-game addicted nephew tells you that

Q68: You are looking over your brother's portfolio.In

Q69: A beta coefficient of + 1 represents

Q71: You own a portfolio that is equally

Q72: An individual's portfolio consists of three separate

Q73: The beta of the market

A) is 1.

B)

Q74: A friend brags that she expects to

Q75: Beta is the slope of the security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents