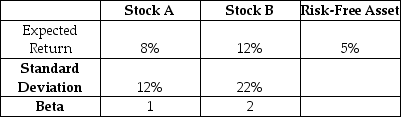

George wants to pick a stock for his Diversified Hedge Fund.The fund has holdings in every country with a stock market.George is trying to decide which asset he should add to his portfolio: Stock A or Stock B.Expected return,Standard deviation and beta values for the two stocks are outlined in the table below.Which stock is best for George's portfolio and why?

A) Stock A because it has a lower Beta.

B) Stock A because it has more return per unit of standard deviation.

C) Stock B because it has a higher return.

D) Stock B because it has a higher Treynor Index with respect to standard deviation.

E) Stock B because it has a higher Treynor Index with respect to Beta.

Correct Answer:

Verified

Q93: You live in an Eichler-built house in

Q94: The risk-free rate is 7 percent,the expected

Q95: When the conclusion of the capital asset

Q96: The table below shows selected financial data

Q97: The table below shows selected financial data

Q99: The expected return on the market is

Q100: When buying on margin,the amount of money

Q101: Assume that the financial markets are in

Q102: The risk-free rate is 5%,the beta of

Q103: The company that prints unemployment insurance checks

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents