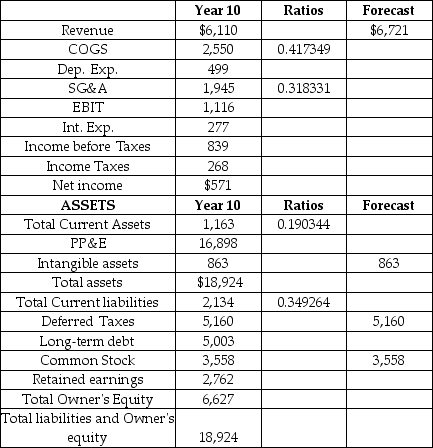

CN Railways is North America's fifth largest railway.Forecast the financial statements for CN for Year 11.Use the percent of sales method based on Year 10 and the assumptions listed below.Please note the ratios to sales provided in the table which are useful for making the forecast.

Sales growth of 10%.The cost of debt is 4.59%.The tax rate is 31.943%.The depreciation rate is 3%.CAPEX is $1,600 Million.The following accounts are constant: Intangible assets,Deferred taxes,and Common Stock.Long term debt is the PLUG variable.No dividends.

Forecast the financial statements for CN.What are the additional funds needed (AFN) in Year 11? The AFN is the change in the plug account from Year 10 to Year 11.

CN Railway Company

Income Statement and Balance Sheet

As of December 31,Year 10 ($ 000,000's)

A) $64 million

B) $165 million

C) $342 million

D) $580 million

E) $965 million

Correct Answer:

Verified

Q25: What are Gerald's purchases expected to be

Q26: Cool Looks imports and distributes sunglasses in

Q27: Cool Looks imports and distributes sunglasses in

Q28: Cool Looks imports and distributes sunglasses in

Q29: Polaris Industries produces a wide range of

Q31: The Blatz Brewing Company produces 25 million

Q32: Blockbuster is a North American video and

Q33: Sales Forecast and Cash Budget

($000,000s)

Q34: Blockbuster is a video rental and retail

Q35: Sales Forecast and Cash Budget

($000,000s)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents