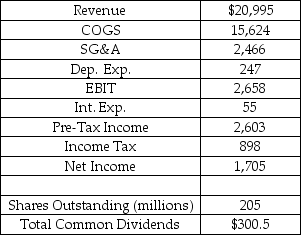

Smith Motors Inc.manufactures,distributes,and services automotive parts and engines worldwide.Smith's income statement for the year just ending is shown below.Assume that today is the first day of Year 2 and that Smith's common shares are trading at a price of $88.In its most recent Management Discussion and Analysis (MD&A) Smith's management forecast earnings-per-share of $7.5 for Year 2.If Smith maintains its Year 1 payout ratio,then what is the dividend yield (based on forecasted earnings) ?

Smith Motors Inc.

Income Statement

Year 1 ($000,000's)

A) 0.88%

B) 1.32%

C) 1.51%

D) 1.76%

E) 2.62%

Correct Answer:

Verified

Q17: Sweetums Inc.,a confectioner best known for its

Q18: Random Dating Corp.operates a number of online

Q19: Kelly Varnsen,a junior financial analyst at Vandalay

Q20: The Pawtucket Brewery uses the residual dividend

Q21: Some investors think that Prestige Entertainment's repurchase

Q23: You are a buy-side analyst researching the

Q24: Acme Explosives Inc.is an international producer of

Q25: Ewing Oil repurchased $5.10B worth of shares

Q26: Cash-2-Day currently trades for $13.Analysts regard it

Q27: Cash-2-Day Company currently trades for $20.Analysts regard

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents