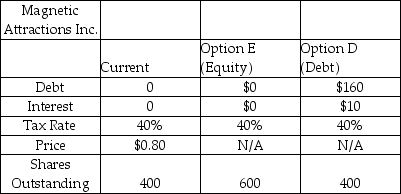

Magnetic Attractions Inc.a web-based dating company,needs to raise capital to finance an expansion in their business.The company is trying to decide between borrowing or issuing more equity.Selected financial information is provided in the table below.The current capital structure is shown in the column labeled "Current." Under Option E,they will sell 200 new shares at the current price.Under Option D,they will borrow $160 at 6.25% and no new equity will be issued.There are currently 400 shares outstanding,and the firm is debt-free.The tax rate is 40%.To help Magnetic Attractions with its decision,what is the EBIT-EPS indifference point?

A) $32

B) $48

C) $16

D) $30

E) $28

Correct Answer:

Verified

Q32: Jerry's Dog Food,Inc.is a dog food wholesaler

Q33: Which of the following statements is true?

A)

Q34: Xtra-Terrestrial Landscapes needs to raise capital to

Q35: Compared with an all-equity financed firm,one that

Q36: When calculating the EBIT-EPS breakeven point,the interest

Q38: If Ubu's Pear Farm expects EBIT to

Q39: As firms become more leveraged,the risk of

Q40: A firm has a projected EBIT of

Q41: Bob's Farm Rental and Party Supply posted

Q42: What is the optimal capital structure?

A) The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents