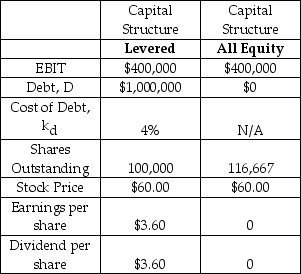

The Mohawk & Hudson Railway (M&H) currently has a levered capital structure,but it is considering a proposal to issue new equity (@$60/share) and use the proceeds to retire its debt.Selected financial information for M&H is provided in the table below.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with an annual coupon rate of 4% (and yield of 4%) .Assume that individual investors can borrow and lend at the same interest rate (and with the same terms) as corporations.

Charlie Jones,an engineer for the railway,owns 100 shares of M&H.Charlie receives annual dividend income of $360 under the current capital structure.Charlie likes the lower risk and the return on investment that he could earn under the proposed all-equity capital structure,but Mohawk & Hudson has announced that it will not go forward with the change in capital structure.If Charlie sells 14.29 shares and lends the proceeds,then what are his annual investment cash flows?

A) $260

B) $294

C) $308

D) $343

E) $360

Correct Answer:

Verified

Q38: If Ubu's Pear Farm expects EBIT to

Q39: As firms become more leveraged,the risk of

Q40: A firm has a projected EBIT of

Q41: Bob's Farm Rental and Party Supply posted

Q42: What is the optimal capital structure?

A) The

Q44: Tarbox Tobacco Inc.is all equity financed and

Q45: Jungle Cat Petting Zoo Inc.is currently all

Q46: The Cripple Creek Railway is currently all

Q47: The Cramden Bus Company is currently all

Q48: Austin-Healey Motors Inc.is currently levered.It used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents