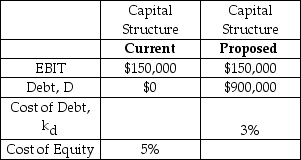

Selected financial information for N7 Tactical Solutions is provided in the table below.N7 is currently all equity financed,but it is considering a leveraged capital structure,details of which are presented in the column labeled "Proposed."

Assume that N7 generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield) of 3%.

If N7 recapitalizes,it will use the borrowed funds to repurchase (and cancel) shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $3,000,000; Equity value: $2,100,000

B) Company value: $3,000,000; Equity value: $3,000,000

C) Company value: $2,100,000; Equity value: $2,100,000

D) Company value: $3,000,000; Equity value: $3,900,000

E) Company value: $5,000,000; Equity value: $4,100,000

Correct Answer:

Verified

Q52: The Naugatuck Railway is currently all equity

Q53: Under the Static Tradeoff Theory,the optimal debt-to-equity

Q54: Parker's Barbecue Inc.operates a chain of restaurants

Q55: Treadless Tires Inc.is currently all equity financed.It

Q56: The Kansas City Southern Railroad (KCSR)currently has

Q58: Climax Motors Inc.is currently all equity financed,but

Q59: The essence of Modigliani and Miller's irrelevance

Q60: According to Modigliani and Miller,altering a firm's

Q61: Fawlty Brake Systems Inc.is all equity financed

Q62: Amish Electronics Inc.is all equity financed and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents