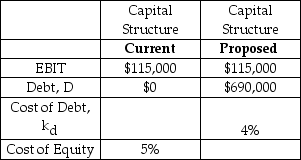

The Cramden Bus Company is currently all equity financed,but it is considering a leveraged capital structure,the details of which are presented in the table under the column labeled 'Proposed'.

Assume that the company generates perpetual annual EBIT.Assume that all cash flows occur at the end of the year and we are currently at the beginning of a year.Assume that taxes are zero.Assume that all of net income is paid out as a dividend.Assume that the debt is perpetual with annual coupons (and yield) of 4%.

If Cramden recapitalizes,it will use the borrowed funds to repurchase (and cancel) shares.Determine both the value of the company and the value of the company's equity if it recapitalizes.

A) Company value: $2,875,000; Equity value: $2,185,000

B) Company value: $2,875,000; Equity value: $2,875,000

C) Company value: $2,185,000; Equity value: $2,185,000

D) Company value: $2,300,000; Equity value: $1,610,000

E) Company value: $2,300,000; Equity value: $2,990,000

Correct Answer:

Verified

Q42: What is the optimal capital structure?

A) The

Q43: The Mohawk & Hudson Railway (M&H)currently has

Q44: Tarbox Tobacco Inc.is all equity financed and

Q45: Jungle Cat Petting Zoo Inc.is currently all

Q46: The Cripple Creek Railway is currently all

Q48: Austin-Healey Motors Inc.is currently levered.It used to

Q49: The Pennsylvania Railroad (PRR)currently has a levered

Q50: Which of the following is NOT a

Q51: The Atchison,Topeka &Santa Fe Railway (ATSFR)is currently

Q52: The Naugatuck Railway is currently all equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents