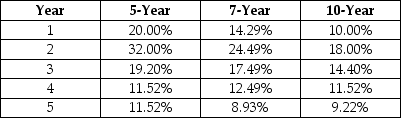

Duddy Kravitz owns the Saint Viateur Bagel store.His world famous bagels are hand rolled,boiled in honey-water and baked in a wood-burning oven.The store sells 5,000 bagels per day and is open 365 days of the year.The bagels are so popular that,on weekends,the customer line-up runs half-way down the block.Uncle Benjy thinks that the wood-fired oven should be replaced by a modern gas oven,which would reduce costs by $0.02 per bagel.A new oven would cost $105,000.Duddy is considering Uncle Benjy's idea,but he only plans to be in business for another two years.The bagels are sold for $0.75 each.The cost of producing each bagel with the wood-burning oven is $0.50 which includes labour and raw materials.The current oven was purchased thirty years ago for $20,000.It could be sold today for $5,000 and will be worth $3,000 in two years.A new oven costs $105,000 today and could be sold for $55,000 in two years.Duddy's cost of capital is 9%.Assume that investment cash flows occur immediately,and that sales and production costs occur at the end of the year.Assume that both ovens are classified as 10-year property and depreciated using the MACRS system.The tax rate is 35%.What is the IRR for the proposed acquisition?

MACRS Depreciation Rates

A) 7.8%

B) 8.8%

C) 9.8%

D) 10.8%

E) 11.8%

Correct Answer:

Verified

Q65: Meals on Wings Inc.,which supplies prepared meals

Q66: The Mountain Jam Company purchased a machine

Q67: You are evaluating two projects.You may accept

Q68: Duddy Kravitz owns the Saint Viateur Bagel

Q69: The Mountain Jam Company purchased a machine

Q71: Equal annual annuities assume projects are renewable

Q72: A new tire balancing machine is available

Q73: The Mountain Jam Company purchased a machine

Q74: Meals on Wings Inc.,which supplies prepared meals

Q75: Duddy Kravitz owns the Saint Viateur Bagel

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents