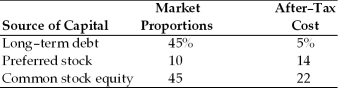

A firm has determined its cost of each source of capital and optimal capital structure,which is composed of the following sources and current market value proportions:  Other things remaining constant,if the firm were to shift toward a capital structure with ________ the weighted average cost of capital will be higher.

Other things remaining constant,if the firm were to shift toward a capital structure with ________ the weighted average cost of capital will be higher.

A) 45% long-term debt, 40% common stock, and 15% preferred stock

B) 60% long-term debt, 20% common stock, and 20% preferred stock

C) 20% long-term debt, 60% common stock, and 20% preferred stock

D) 60% long-term debt, 30% common stock, and 10% preferred stock

Correct Answer:

Verified

Q93: What would be the cost of new

Q97: What would be the cost of retained

Q101: In computing the weighted average cost of

Q105: Historical weights are the present value of

Q107: A firm has determined its cost of

Q111: The weights used in weighted average cost

Q112: Weights that use accounting values to measure

Q113: A firm may face increase in the

Q115: When discussing weighing schemes for calculating the

Q120: The preferred capital structure weights to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents