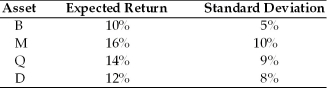

Given the following expected returns and standard deviations of assets B,M,Q,and D,which asset should the prudent financial manager select?

A) Asset B

B) Asset M

C) Asset Q

D) Asset D

Correct Answer:

Verified

Q41: The _ of a given outcome is

Q42: _ is the extent of an asset's

Q44: A common approach of estimating the variability

Q48: The simplest type of probability distribution is

Q50: Standard deviation measures the dispersion of an

Q53: Higher the coefficient of variation, the greater

Q55: A _ is a measure of relative

Q58: For normal probability distributions, 95 percent of

Q60: A _ measures the dispersion around the

Q64: The standard deviation of a portfolio is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents