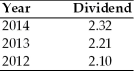

China America Manufacturing has a beta of 1.50,the risk-free rate of interest is currently 12 percent,and the required return on the market portfolio is 18 percent.The company plans to pay a dividend of $2.45 per share in the coming year and anticipates that its future dividends will increase at an annual rate consistent with that experienced over the 2001-2003 period.  Estimate the value of China America Manufacturing's stock.

Estimate the value of China America Manufacturing's stock.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: Table 7.1 Q147: The free cash flow valuation model is Q150: Ted has 10 shares of Grand Company. Q154: The Oxford Heating Company has been very Q155: The free cash flow valuation model can Q156: Tina's Medical Equipment Company paid $2.25 common Q158: The free cash flow valuation model is Q159: Compute the value of a share of Q160: Ria's Doll Company has an outstanding preferred Q161: The liquidation value per share of common![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents