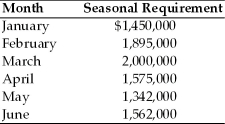

Studio San,a dealer in contemporary art,has forecasted its seasonal financing needs for the next six months as follows:  (a)The firm projects that short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(a)The firm projects that short-term funds will cost 11 percent and long-term funds will cost 13 percent annually.

(b)The firm's permanent funds requirement is $500,000.

Calculate financing costs for the first six months using the aggressive and conservative strategies.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Adong's Fishing Products is analyzing the performance

Q123: The ABC system is an inventory management

Q127: A firm's financing requirements can be separated

Q129: The basic strategies that should be employed

Q131: Jia's Jewelers has seasonal financing needs that

Q133: In EOQ model, the average inventory is

Q134: For minimizing the cash conversion cycle, a

Q137: The reorder point is the point at

Q139: The basic strategies for determining the appropriate

Q139: Table 14.3 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents