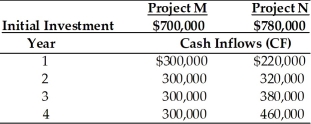

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the NPV for Project N is ________.(See Table 11.8)

A) $166,132

B) $122,970

C) $85,732

D) $600,000

Correct Answer:

Verified

Q65: The theoretical basis from which the concept

Q67: When unequal-lived projects are independent, the length

Q68: A preferred approach for risk adjustment of

Q78: In case of unequal-lived, mutually exclusive projects,

Q80: Firms do not usually get rewarded by

Q144: Table 11.7

A firm is considering investment in

Q145: Table 11.8

Tangshan Mining Company is considering investment

Q150: Which project would be preferable if both

Q151: Table 11.7

A firm is considering investment in

Q152: Table 11.9

Johnson Farm Implement is faced with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents