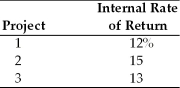

A firm with a cost of capital of 13 percent is evaluating three capital projects.The internal rates of return are as follows:  The firm should ________.

The firm should ________.

A) accept Project 1 and 2, and reject Project 3

B) accept Project 2, and reject Projects 1 and 3

C) accept Project 1, and reject Projects 2 and 3

D) accept Project 3, and reject Projects 1 and 2

Correct Answer:

Verified

Q141: The _ is the compound annual rate

Q142: The appeal of the IRR technique is

Q143: Certain mathematical properties may cause a project

Q144: Which capital budgeting method is most useful

Q145: The _ is the discount rate that

Q146: On a purely theoretical basis, NPV is

Q148: On a purely theoretical basis, NPV is

Q151: The financial decision makers find NPV more

Q153: Table 10.4

A firm must choose from six

Q157: Unlike the net present value criteria, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents