Valuation of a Merger Windows N Such,Inc.,is asking a price of $195 million to be purchased by Curtain Rods Corp.The two firms currently have cumulative total cash flows of $15 million which are growing at 1 percent annually.Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 3 percent for the first four years following the merger.After the first four years cash flows will grow at a rate of 2 percent.The WACC for the merged firms is 10 percent.Calculate the NPV of the merger.Should Curtain Rods Corporation agree to acquire Windows N Such,Inc.,for the asking price of $195 million?

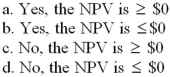

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q46: Calculation of Average Costs with Economies of

Q47: Calculation of Average Costs with Economies of

Q48: Calculation of Bankruptcy Probability A linear probability

Q49: Economies of Scope A survey of a

Q50: Calculation of Average Costs with Economies of

Q52: Calculation of Average Costs with Economies of

Q53: Calculation of Average Costs with Economies of

Q54: Economies of Scope A survey of a

Q55: Calculation of Bankruptcy Probability Suppose a linear

Q56: Calculation of Change in the HHI Associated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents