Valuation of a Merger You own stock in Carpet City,Inc.,which has just made a bid of $165 million to purchase Tile Corporation.The two firms currently have cumulative total cash flows of $25 million which are growing at 2 percent annually.Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 4 percent for the first three years following the merger.After the first three years cash flows will grow at a rate of 3 percent.The merged firms are expected to have a beta = 1.75,the risk-free rate is 5.5 percent,and the market risk premium is currently 7.5 percent.Calculate the NPV of the merger.Will you vote in favor of the merger?

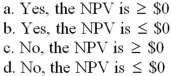

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q38: Calculation of Change in HHI Associated with

Q39: Calculation of Altman's Z-Score: Suppose that the

Q40: Calculation of Average Costs with Economies of

Q41: Calculation of Change in the HHI Associated

Q42: Valuation of a Merger Department Stores,Inc.,is asking

Q44: Calculation of Average Costs with Economies of

Q45: Calculation of Bankruptcy Probability Suppose a linear

Q46: Calculation of Average Costs with Economies of

Q47: Calculation of Average Costs with Economies of

Q48: Calculation of Bankruptcy Probability A linear probability

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents