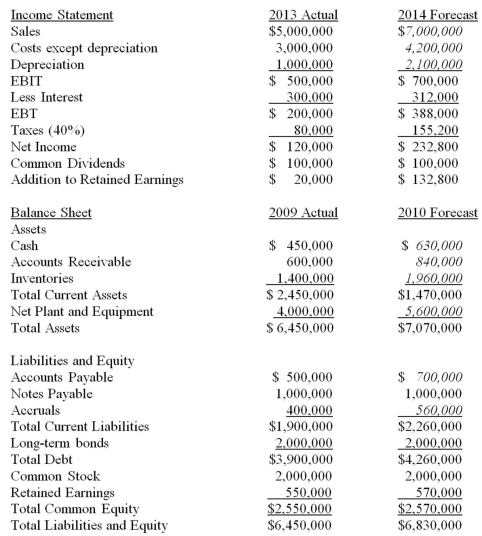

Suppose that the 2013 actual and 2014 projected financial statements for Carrier Corp.are initially as shown in the following tables.In these tables,sales are projected to rise 40 percent in the coming year,and the components of the income statement and balance sheet that are expected to increase at the same 40 percent rate as sales are indicated with an italics font.Assuming that Carrier Corp.wants to cover the AFN with 50 percent equity,25 percent long-term debt,and the remainder from notes payable,what amount of additional funds will they need to raise if debt carries a 10 percent interest rate?

A) $120,000 equity; $60,000 long-term debt; $60,000 notes payable

B) $60,000 equity; $120,000 notes payable; $60,000 long-term debt

C) $60,000 equity; $120,000 long-term debt; $60,000 notes payable

D) None of these answers is correct

Correct Answer:

Verified

Q44: Suppose a firm has had the historical

Q46: Suppose that Gyp Sum Industries currently has

Q47: Suppose that the 2013 actual and 2014

Q48: Suppose a firm has had the historical

Q48: Goldilochs Inc. reported sales of $5 million

Q50: Suppose that the 2013 actual and 2014

Q51: Suppose a firm has had the historical

Q52: Suppose that Wind Em Corp.currently has the

Q54: Suppose that the 2013 actual and 2014

Q57: Goldilochs Inc. reported sales of $8 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents