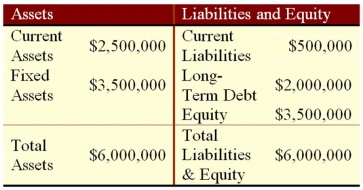

Suppose that Psy Ops Industries currently has the balance sheet shown as follows,and that sales for the year just ended were $6 million.The firm also has a profit margin of 9 percent,a retention ratio of 5 percent,and expects sales of $8.5 million next year.If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales,how much additional funds will Psy Ops need from external sources to fund the expected growth?

A) $795,100

B) $141,300

C) $783,600

D) $214,900

Correct Answer:

Verified

Q37: Suppose a firm has had the historical

Q38: Suppose a firm has had the historical

Q39: Suppose a firm has had the historical

Q40: Suppose a firm has had the historical

Q41: Suppose that Wind Em Corp.currently has the

Q43: Suppose a firm has had the historical

Q44: Suppose a firm has had the historical

Q46: Suppose that Gyp Sum Industries currently has

Q47: Suppose that the 2013 actual and 2014

Q57: Goldilochs Inc. reported sales of $8 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents