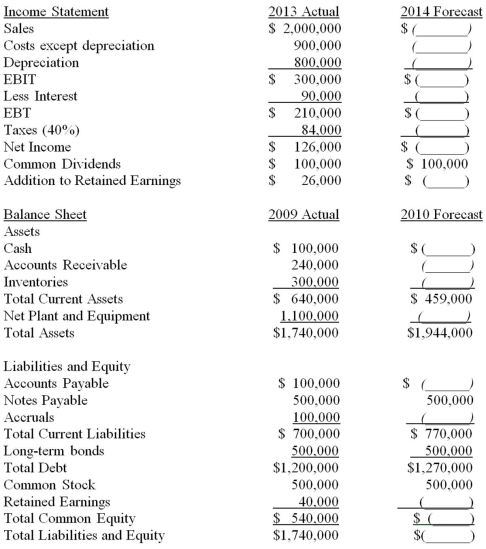

Suppose that the 2013 actual and 2014 projected financial statements for CMT Corp.are initially as shown in the following tables.In these tables,sales are projected to rise 35 percent in the coming year,and the components of the income statement and balance sheet that are expected to increase at the same 35 percent rate as sales need to be calculated and are indicated with a blank space (___).Assuming that CMT Corp.wants to cover the AFN with 30 percent equity,35 percent long-term debt,and the remainder from notes payable,what amount of additional funds will they need to raise if debt carries a 9 percent interest rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Suppose you were forecasting sales for a

Q82: Contrast the difference between first order effects

Q83: Which of the following statements is correct?

A)The

Q84: Explain the process of financial planning process

Q85: Explain when it is appropriate to use

Q86: What are two issues that are not

Q87: Which liabilities would tend to spontaneously increase

Q88: The financial plan is an important element

Q89: How is the capital intensity ratio calculated?

Q92: Is forecasting more important for small firms

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents