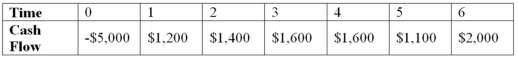

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

A) IRR = 16.92 percent; accept the project

B) IRR = 7.123 percent; reject the project

C) IRR = 18.32 percent; accept the project

D) IRR = 7.59 percent; reject the project

Correct Answer:

Verified

Q67: Suppose your firm is considering investing in

Q68: Compute the NPV statistic for Project Y

Q69: Compute the MIRR statistic for Project I

Q70: Compute the PI statistic for Project Q

Q71: Suppose your firm is considering investing in

Q73: Suppose your firm is considering investing in

Q74: Suppose your firm is considering investing in

Q75: Suppose your firm is considering investing in

Q76: Suppose your firm is considering investing in

Q77: Compute the MIRR statistic for Project J

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents