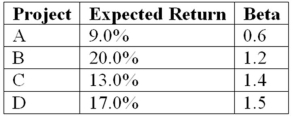

An all-equity firm is considering the projects shown as follows.The T-bill rate is 4 percent and the market risk premium is 7 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s) ,if any,will be incorrectly accepted or rejected?

A) Project A would be incorrectly rejected.

B) Both Projects A and C would be incorrectly rejected.

C) Project A will be incorrectly rejected and Project B would be incorrectly accepted.

D) None of the projects will be incorrectly accepted or rejecteD.Step 1: Find Project Required Returns using CAPM.Project A: 8.2 percent; Project B: 12.4 percent; Project C: 13.8 percent; Project D: 14.5 percent; Project A would be incorrectly rejected since its required return is only 8.2 percent given its risk and it is expected to return 9 percent.Project C would be incorrectly accepted since it should earn 13.8 percent given its risk.

Correct Answer:

Verified

Q84: Which of the following will directly impact

Q85: ADK has 30,000 15-year 9 percent annual

Q85: ADK Industries common shares sell for $40

Q88: Which of the following statements is correct?

A)If

Q88: Which of the following statements is correct?

A)The

Q91: Suppose your firm has decided to use

Q94: Which of the following will directly impact

Q97: Which of the following is a situation

Q98: Suppose your firm has decided to use

Q98: Which of following is a situation in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents