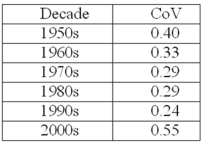

Consider the risk-return relationship in T-bills during each decade since 1950.Given this data,which of the following statements is correct?

A) The best risk-return relationship was during the 1950s.

B) The best risk-return relationship was during the 1990s.

C) Since T-bills are backed by the full faith of the U.S.government, computing the risk-return relationship for them is invalid.

D) None of these statements is correct.

Correct Answer:

Verified

Q59: Portfolio Weights You have $15,040 to invest.You

Q60: Portfolio Return The following table shows your

Q61: The past five monthly returns for PG&E

Q62: At the beginning of the month, you

Q62: If you own 400 shares of Xerox

Q63: Jenna receives an investment newsletter that recommends

Q64: You have $10,000 to invest. You want

Q65: Which of the following is correct regarding

Q74: Compute the standard deviation of Kohl's monthly

Q80: Jane Adams invests all her money in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents