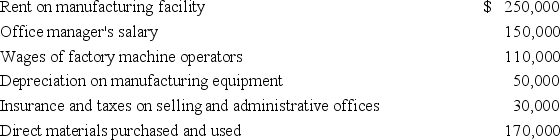

Steuben Company produces dog houses. During the current year, Steuben Company incurred the following costs:  Based on the above information, which of the following would not be treated as a product cost:

Based on the above information, which of the following would not be treated as a product cost:

A) office manager's salary

B) rent expense incurred on manufacturing facility

C) depreciation on manufacturing equipment

D) salaries of factory machine operators

Correct Answer:

Verified

Q22: What is the effect on the balance

Q28: Costs such as transportation-out,sales commissions,uncollectible accounts receivable,and

Q36: During its first year of operations,Silverman Company

Q40: During its first year of operations,Silverman Company

Q41: Randall Company manufactures chocolate bars. The following

Q43: As a Certified Management Accountant,Derek is bound

Q46: Steuben Company produces dog houses. During the

Q58: Which of the following is not one

Q59: As a Certified Management Accountant,Grace is bound

Q60: Certified Management Accountants (CMA)must complete a specified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents